In March 2016, China's TiO2 market continued to recover. After leading domestic companies

took the lead on raising product prices, the third round of price rises since

Jan. 2016 has swept across the country. CCM believes that the previously low

operating rate of the industry and the frequent release of favorable policies

for the real estate industry have been the key supporting factors behind the

price rises. China's TiO2 market is expected to remain in good

health over the following one to three months.

In

early March 2016, after leading Chinese TiO2 players such as Sichuan

Lomon Titanium Co., Ltd. (Sichuan Lomon) raised their rutile TiO2 prices by about USD45.88/t (RMB300/t), a string of approximately 30 TiO2 manufacturers from around the country also raised their product prices by about

USD30.59-76.47/t (RMB200-500/t).

It

is worth noting that this has been the third round of collective price rises in

China's TiO2 market since Jan. 2016. The first two were in early

Jan. and late Jan. respectively, with increases of about USD45.88/t (RMB300/t)

each time. Thus, overall, the market price of TiO2 has increased by

about USD152.94/t (RMB1,000/t) compared with that before the first price rise

in early Jan.

According

to CCM's research, as of 21 March, 2016, mainstream quotations for sulfate grade

rutile TiO2 in China reached USD1,605.87/t (RMB10,500/t) and those

for anatase TiO2 hit USD1,407.05/t (RMB9,200/t).

CCM

believes that the previously low operating rate of the industry and the

frequent release of favorable policies for the real estate industry are the

major supporting factors behind the price rises.

1.

Pre-existing low operating rate changes situation of oversupply

Over

the second half of 2015, China's TiO2 price continued dropping,

falling by 24% compared with that in the first half of 2015 to USD1,452.53/t

(RMB9,500/t), almost reaching the level of production costs and panicking

domestic manufacturers.

After

the market price dropped to its lowest point in 2015, many domestic small and

medium sized TiO2 manufacturers such as Jiangxi Tikon Titanium Co.,

Ltd. and Luohe Xingmao Titanium Industry Co., Ltd. could no longer continue to

turn a profit and had no alternative but to halt production and carry out

overhauls on their production equipment. In addition to this, large scale

enterprises such as Henan Billions Chemicals Co., Ltd. and Shandong Doguide

Group Co., Ltd. reduced their operating rates at the end of the year.

As

the operating rate of the industry collapsed, the situation of oversupply began

to change. China's TiO2 market turned into a seller's market and TiO2 manufacturers, no longer burdened by inventory pressure, regained the

confidence to raise their product prices.

2.

Favorable policies frequently released to bolster real estate market

Since

Jan. 2016, the Chinese government has been releasing favorable policies for the

domestic real estate industry:

-

On 1 Jan.,

the individual housing provident fund rate on loans was cut

-

In early

Feb., the minimum down payment ratio was lowered

-

During

China's Two Sessions (the National People's Congress and the Chinese Political

Consultative Conference) in March, "the acceleration of the process of

destocking the real estate industry", "the encouragement of companies

to purchase houses", etc., have been put forward by the government

China's

real estate industry has flourished under the support of favorable policies and

both sales volumes and the price of housing has increased in first- and

second-tier cities.

As

an important downstream market for the TiO2 industry, the

flourishing real estate industry stimulates the development of the TiO2 industry.

In

addition, CCM predicts that China's TiO2 market will remain in good

health over the next one to three months.

Though

the price of TiO2 has increased three times since Jan. 2016, the

price of sulfate grade rutile TiO2, USD1,605.87/t (RMB10,500/t) is

still at an all-time low. According to CCM's research, the comprehensive

production cost of TiO2 in China is about USD1,529.40/t

(RMB10,000/t). When adding in other costs incurred for middleman, logistics,

etc., most manufacturers are still unable to reap profits. In other words, the

increased price of TiO2 still cannot stimulate manufacturers to

resume production on a large scale and the operating rate of the industry

remains low. Thus, the relationship between supply and demand is expected to

remain stable in the short term.

Furthermore,

favorable supporting policies will not bolster the sagging real estate industry

overnight. It will take time for them to improve the situation of the industry.

The Chinese government will also very likely release more favorable policies to

stimulate the market. Thus, it is safe to assume that support for the TiO2 market from the real estate industry will not recede in the short term.

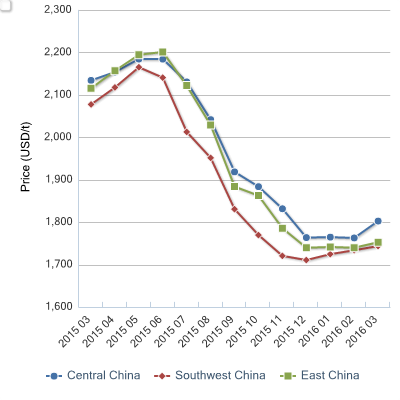

Ex-works price of

rutile TiO2 in China by region, mid-March 2015–mid-March 2016

Source: CCM

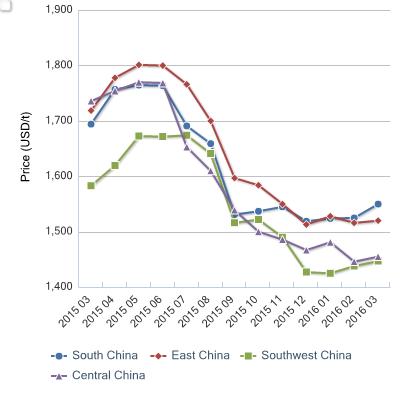

Ex-works price of

anatase TiO2 in China by region, mid-March 2015 to mid-March 2016

Source: CCM

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: TiO2